Rike Chemical 2023 Interim Report: Revenue Under Pressure, Continuous Growth in R&D Investment

"Rike Chemical (stock code: 300214) is a company specializing in the research, development, production, and sales of plastic and rubber modifier products. The company provides comprehensive solutions from compound formulation, compound processing technology, new product development to customer service, with main products including ACR and ACM plastic modifiers. These modifiers are widely used in the production of various plastic and rubber products. Centered on customer expectations, the company has established ACR and ACM business divisions, providing comprehensive solutions suitable for customer processes and equipment characteristics through continuous communication, joint research and development, and feedback with customers.

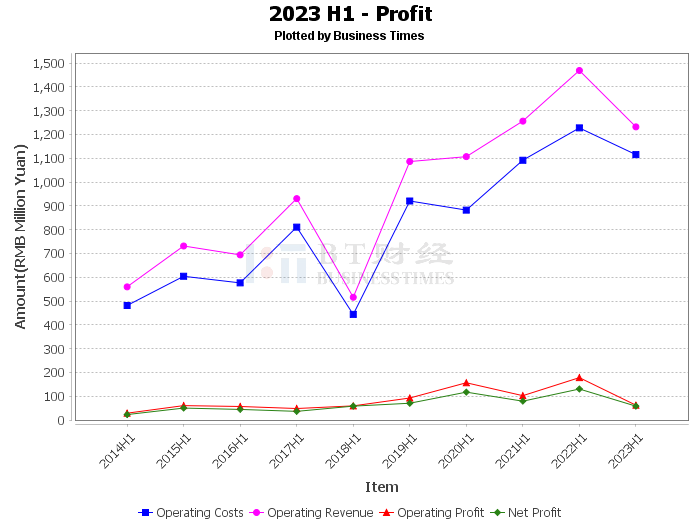

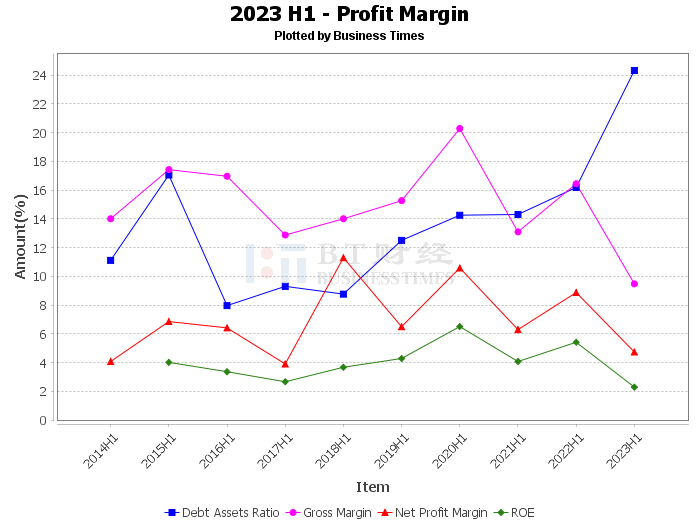

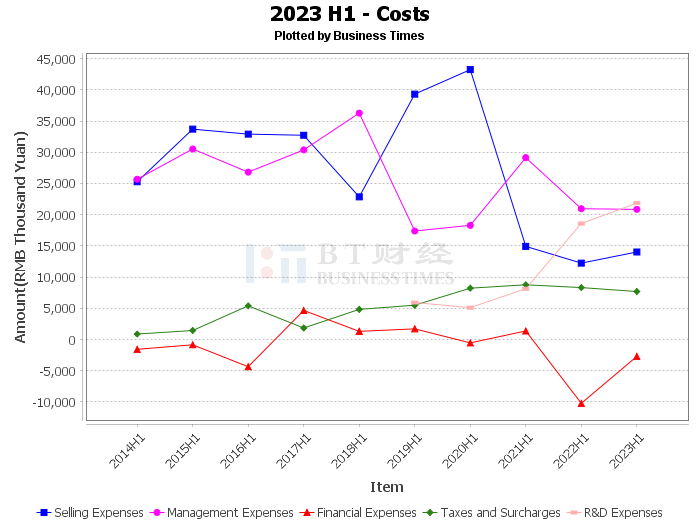

Rike Chemical's 2023 interim report shows that the company's operating income decreased by 16.13% year-on-year, mainly due to a decrease in sales caused by a drop in product prices. Operating costs decreased by 9.14% year-on-year, mainly due to a decrease in raw material prices leading to a reduction in costs. Sales expenses increased by 14.52% year-on-year, mainly due to fluctuations in sales personnel salaries. Financial expenses decreased by 73.51% year-on-year, mainly due to the impact of foreign exchange gains and losses. Income tax expenses decreased by 69.22% year-on-year, mainly due to a decrease in operating profit for the current period.

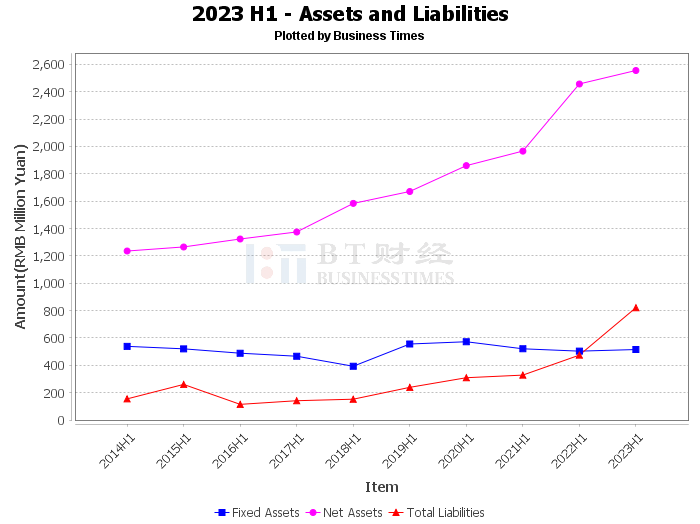

The company has shown a positive performance in R&D investment, with a year-on-year increase of 17.51%, demonstrating the company's emphasis on technological innovation and product development. However, the net cash flow from operating activities decreased by 77.34% year-on-year, mainly due to a decrease in business profits and a decrease in the net cash flow from operating activities. The net cash flow from investment activities decreased by 586.89% year-on-year, mainly due to the company's purchase of bank wealth management products and large deposits with temporarily idle funds. The net cash flow from financing activities increased by 5,745.92% year-on-year, mainly due to the increase in short-term and long-term borrowings in the current period.

The company's other income increased by 290.81% year-on-year, mainly due to an increase in government subsidies received in the current period. Investment income increased by 75.66% year-on-year, mainly due to income from entrusted loans. Credit impairment losses decreased by 92.71% year-on-year, mainly due to high credit impairment losses in the previous period due to full provision for bad debts of HSBC. Asset impairment losses were mainly due to provisions for inventory depreciation for stagnant inventory. Non-operating income increased by 2,243.89% year-on-year, mainly due to large gains from mergers of non-identical controlled enterprises in the current period. Non-operating expenses decreased by 98.94% year-on-year, mainly due to the scrapping of equipment upgrades in the previous period.

In general, Rike Chemical's performance in the first half of 2023 was under some pressure, with both operating income and operating profit declining. However, the company's growth in R&D investment shows its emphasis on technological innovation and product development. At the same time, the company successfully increased cash flow through financing activities, providing financial security for the company's subsequent development.

For investors, the financial status and performance of Rike Chemical need to be closely monitored. Although the company has shown a positive attitude in R&D investment and financing activities, the decline in the company's operating income and profits, as well as the decrease in cash flow from operating activities, all show that the company is under certain pressure in its operations. Therefore, when making investment decisions, investors need to consider the company's various financial indicators and performance comprehensively.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."