Suzhou Bank's Q3 2023 Report: Slight Decrease in Debt-to-Asset Ratio, Increase in Net Profit, Steady Performance

"Suzhou Bank (stock code: 002966) is a corporate city commercial bank headquartered in Suzhou. Its business scope includes accepting public deposits, issuing loans, handling settlements, bill acceptance and discounting, and acting as an agent for the issuance and redemption of government bonds, etc. The company has a locational resource advantage in the Suzhou area, benefiting from its geographical location in the core hinterland of the Yangtze River Delta, closely connected to Shanghai, and enjoying the effect of urbanization.

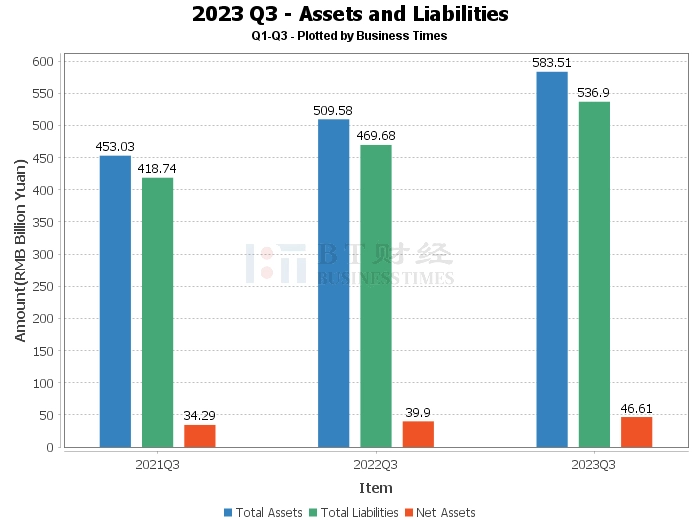

From the perspective of assets and liabilities, the total assets of Suzhou Bank reached 5835.1 billion yuan at the end of the third quarter of 2023, an increase from 5245.49 billion yuan at the end of the previous year. The total liabilities were 5369.01 billion yuan, compared to 4840.87 billion yuan at the end of the previous year. Net assets were 466.09 billion yuan, compared to 404.62 billion yuan at the end of the previous year. The asset-liability ratio was 92.01%, a slight decrease from 92.29% at the end of the previous year.

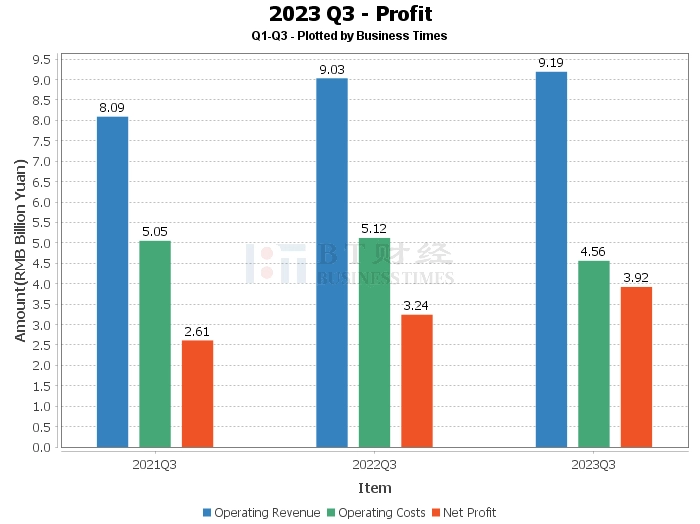

In terms of profits, Suzhou Bank's operating income in the third quarter of 2023 was 91.88 billion yuan, slightly higher than 90.25 billion yuan in the same period of the previous year. Operating profit was 46.27 billion yuan, higher than 39.01 billion yuan in the same period of the previous year. Net profit was 39.21 billion yuan, an increase from 32.4 billion yuan in the same period of the previous year. The gross profit margin was 149.64%, a decrease from 156.78% in the same period of the previous year. The net profit margin was 42.68%, an increase from 35.9% in the same period of the previous year. The return on equity (ROE) was 9.01%, an increase from 8.73% at the end of the previous year.

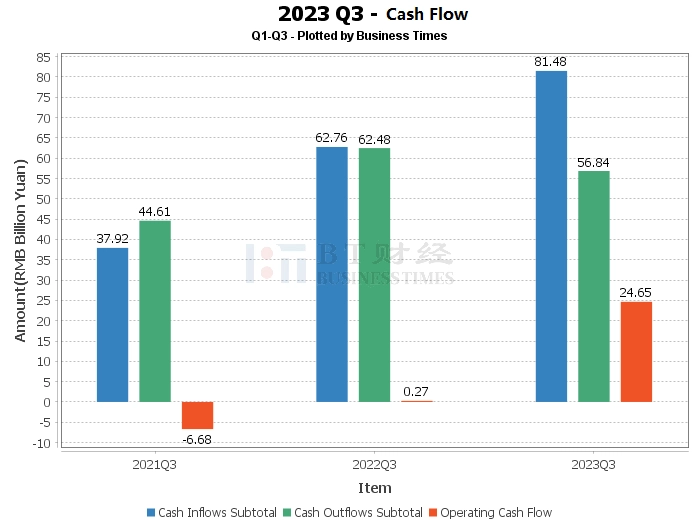

In terms of cash flow, specific data such as the net cash flow generated by Suzhou Bank's operations, the cash inflow generated by operating activities, and the cash outflow generated by operating activities were not given in the financial report summary, so a detailed analysis cannot be conducted.

Overall, Suzhou Bank's operating conditions were stable in the third quarter of 2023. The asset-liability ratio decreased slightly, net profit increased, and the return on equity (ROE) increased, showing that Suzhou Bank's operating efficiency is steadily improving.

For investors, Suzhou Bank, as a city commercial bank with a locational advantage, its stable operating conditions and good profitability make it of high investment value. However, investors should also note that changes in the operating environment and policy environment of the banking industry may affect the operating conditions of Suzhou Bank. Therefore, when making investment decisions, investors should consider various factors and make decisions cautiously.

This article only represents the judgment made by the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."