China Energy Conservation and Environmental Protection Group Co.,Ltd 2023 Interim Report: Slight Increase in Total Assets, Reduced Net Profit Loss, Improved Cash Flow Situation

"China Energy Conservation and Environmental Protection Group Co.,Ltd. (stock code: 300197), a leading company in the ecological and environmental protection industry in Shenzhen, recently released its 2023 interim report. The company, with design, research and development, and technology as its core competitive advantages, actively participates in the construction of ecological civilization in the Guangdong-Hong Kong-Macao Greater Bay Area and the pilot demonstration area in Shenzhen. It also responds to the national strategy of the CPC Central Committee on ecological protection and high-quality development in the Yangtze and Yellow River basins, promoting the green transformation of economic and social development.

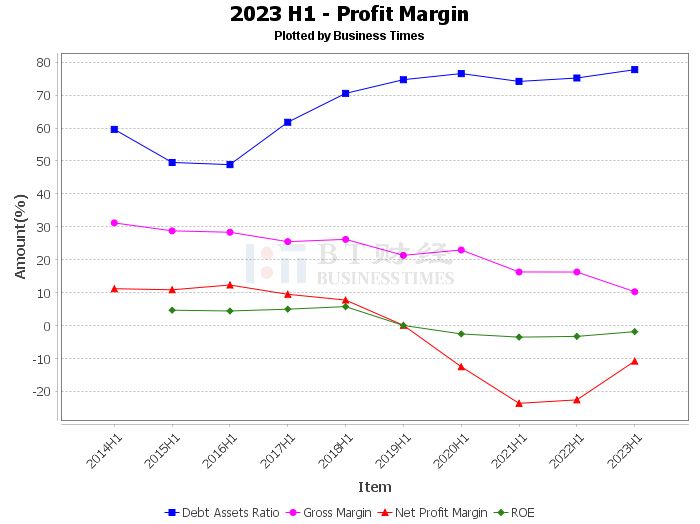

Looking at the financial report data, the total assets of Energy Iron Man in 2023 were 32.3 billion yuan at the end of the period, an increase from the initial 31.9 billion yuan. The total liabilities at the end of the period were 25.1 billion yuan, an increase from the initial 24.8 billion yuan. The company's goodwill at the end of the period and the initial balance were both 753 million yuan, with no change. The net assets at the end of the period were 7.2 billion yuan, an increase from the initial 7.009 billion yuan. The asset-liability ratio at the end of the period was 77.74%, a decrease from the initial 78%.

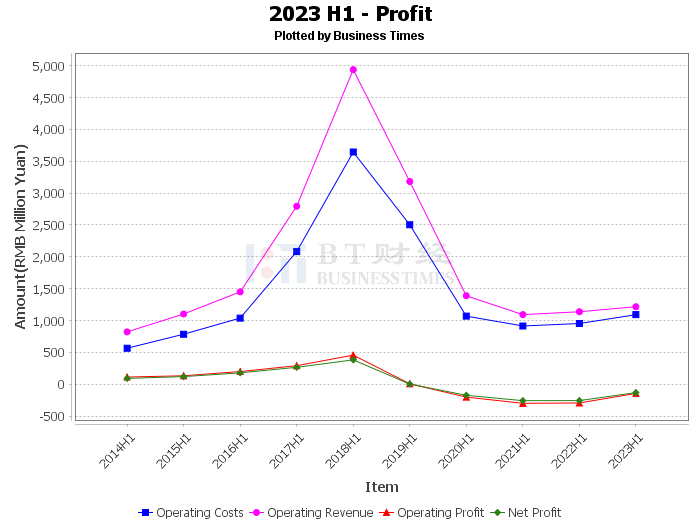

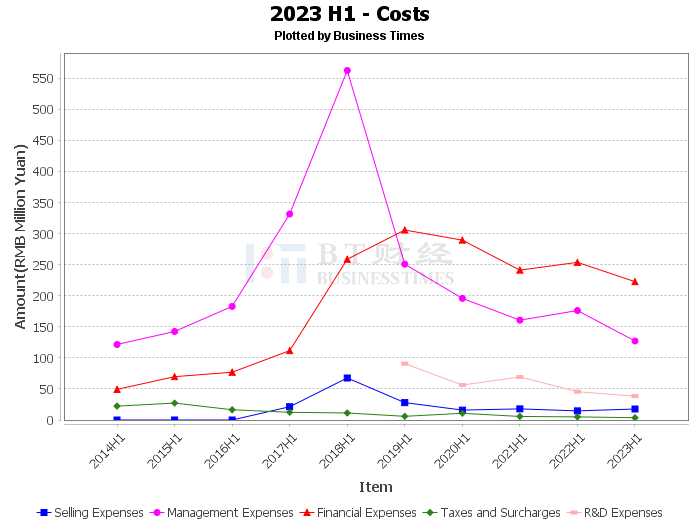

In terms of profitability, the company's gross profit margin for this reporting period was 10.29%, a decrease from 16.26% in the same period last year. The net profit margin for this reporting period was -10.81%, a decrease in losses from -22.57% in the same period last year. The return on equity (ROE) for this reporting period was -1.85%. The operating income for this reporting period was 1.217 billion yuan, an increase from 1.138 billion yuan in the same period last year. The operating profit for this reporting period was -145 million yuan, a decrease in losses from -294 million yuan in the same period last year. The operating cost for this reporting period was 1.092 billion yuan, an increase from 953 million yuan in the same period last year. The net profit for this reporting period was -132 million yuan, a decrease in losses from -257 million yuan in the same period last year.

In terms of cash flow, the net cash flow generated by operating activities for this reporting period was -338 million yuan, a decrease in losses from -77.3 million yuan in the same period last year. The net cash flow generated by investment activities for this reporting period was 270 million yuan, a decrease from 317 million yuan in the same period last year. The net cash flow generated by financing activities for this reporting period was 505 million yuan, turning from a loss of -547 million yuan in the same period last year. The balance of cash and cash equivalents at the end of the period for this reporting period was 1.292 billion yuan, an increase from 1.227 billion yuan in the same period last year.

Overall, the 2023 interim report of China Energy Conservation and Environmental Protection Group Co.,Ltd shows that the company has grown in total assets, net assets, and cash, with a decrease in net profit losses and an improvement in cash flow. However, the company's gross profit margin, net profit margin, and net cash flow generated by investment activities have all decreased, indicating that the company still faces certain pressures in terms of profitability and investment activities. For investors, it is necessary to pay attention to the company's future profitability and the progress of investment activities, as well as how the company further improves asset utilization efficiency, optimizes debt structure, and improves profitability and cash flow.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."