Sinogeo 2023 Interim Report: Facing Challenges, Seeking Breakthroughs

"Sinogeo Co., Ltd. (stock code: 300191) is a company specializing in oil and gas exploration and development. According to the 2023 interim report, the company faced some challenges during the reporting period, but also achieved certain results in the field of oil and gas exploration and development.

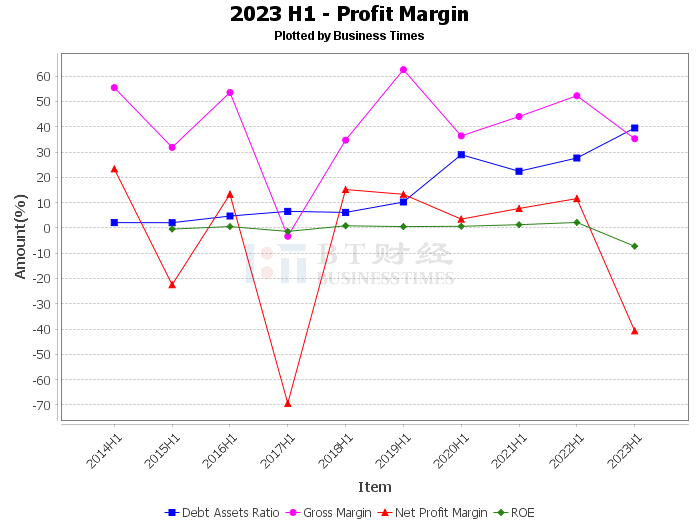

During the reporting period, the company achieved operating income of RMB 217.56 million, a year-on-year decrease of 5.69%. This decrease was mainly due to the decline in crude oil prices and increased extraction costs of the Jiu 1-Jiu 5 project in the Junggar Basin of Xinjiang, which led to a decrease in profits. Meanwhile, the company's operating profit was RMB -83.60 million, a year-on-year decrease of 336.32%. This decrease was mainly due to the drilling exploration expenditure of the Bohai 05/31 contract area being included in the current profit and loss. In addition, the company's net profit attributable to the parent company's shareholders was RMB -88.63 million, a year-on-year decrease of 434.30%.

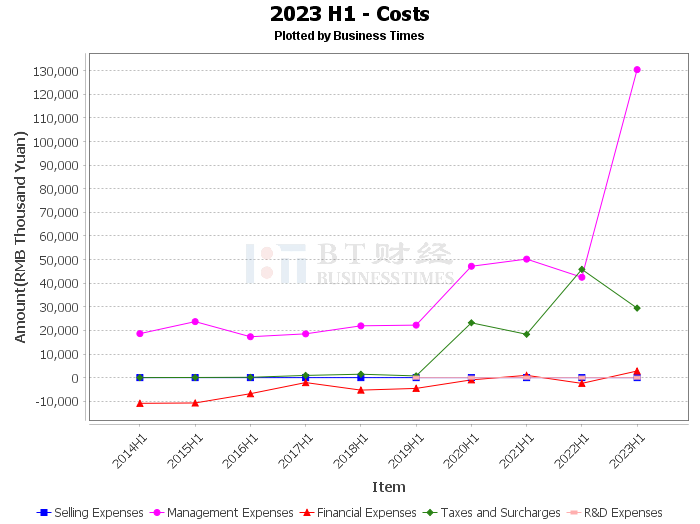

In terms of costs, the company's operating costs increased by 27.88% year-on-year, mainly due to the increase in oil and gas asset depreciation, well operations and other production measures costs, and other oil and gas extraction costs. Administrative expenses increased by 206.92% year-on-year, mainly due to the drilling exploration expenditure of RMB 83.07 million related to the temporarily capitalized CFD2-4-1 well and CFD2-4-2D well in the Bohai 05/31 contract area being included in administrative expenses. Financial expenses increased by 214.95% year-on-year, mainly due to the decrease in foreign currency assets, smaller exchange rate changes compared to the same period last year, and a decrease in exchange gains; loans and interest expenses increased during this reporting period.

In terms of cash flow, the net cash flow generated by the company's operating activities decreased by 45.12% year-on-year, mainly due to the decrease in production operation fees received from partners compared to the same period last year. The net cash flow generated by investment activities decreased by 68.31% year-on-year, mainly due to the increase in exploration and development operations and increased external settlement expenditures; fixed deposits increased during this reporting period. The net cash flow generated by financing activities decreased by 123.08% year-on-year, mainly due to the decrease in new bank loans and an increase in the amount of loan repayments and interest.

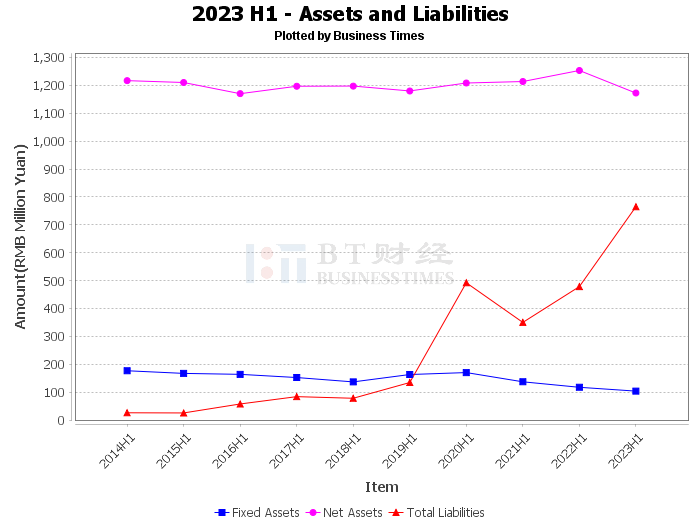

In terms of assets and liabilities, the company's total assets were RMB 1.937 billion, total liabilities were RMB 765 million, and net assets were RMB 1.172 billion. The asset-liability ratio was 39.48%, which was higher than the 36.38% at the beginning of the period.

In general, Sinogeo faced some challenges during the reporting period, including falling crude oil prices, increased extraction costs, and increased drilling exploration expenditures. However, the company also made significant breakthroughs in exploration and major oil and gas discoveries in cooperation blocks such as the Bohai Sea and the South China Sea, demonstrating the company's strength in the field of oil and gas exploration and development.

In the future, Sinogeo needs to further improve oil and gas extraction efficiency and reduce extraction costs to cope with fluctuations in crude oil prices. At the same time, the company also needs to continue to increase exploration efforts to find new oil and gas resources to ensure the company's long-term development.

For investors, Sinogeo is a company with certain strength in the field of oil and gas exploration and development, but it also faces some challenges. When investing in Sinogeo, investors need to fully consider these factors and make rational investment decisions.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."