ST Dvsx 2023 Interim Report: Challenges and Opportunities under Diversified Operations

ST Dvsx (stock code: 300167) is a diversified business company, with its main business and non-main business. In the 2023 interim report, we can see that the company has core competitiveness in the main business field, and also has some business expansion in the non-main business field. The company's assets and liabilities are relatively stable, and some investment activities have also been carried out.

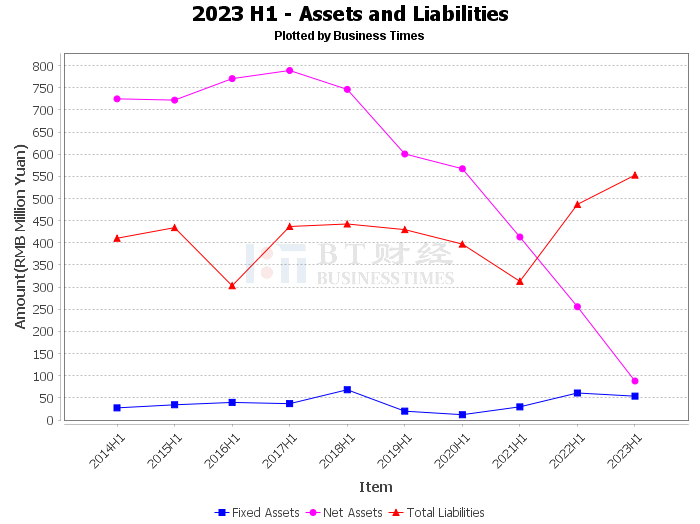

From the financial report data, we can see that the total assets of ST Dvsx at the end of the period were 641 million yuan, which was slightly decreased compared to the beginning of the period of 708 million yuan. The total liabilities at the end of the period were 553 million yuan, which was also slightly decreased compared to the beginning of the period of 573 million yuan. This may indicate that the company had some asset impairment or debt repayment during the reporting period. Meanwhile, the company's goodwill at the end of the period was 90.9 million yuan, which was consistent with the beginning of the period, indicating that the company did not carry out large-scale mergers and acquisitions during the reporting period.

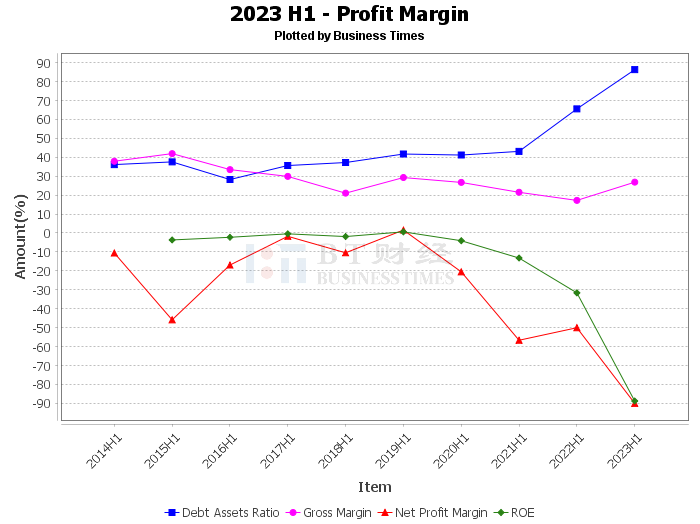

The company's net assets at the end of the period were 87.9 million yuan, which was slightly decreased compared to the beginning of the period of 135 million yuan. This may be due to the company's losses during the reporting period. The asset-liability ratio at the end of the period was 86.27%, which was slightly increased compared to the beginning of the period of 80.96%. This may be due to the company's increase in liabilities or decrease in assets.

In terms of profitability, the company's gross profit margin for this reporting period was 26.84%, which was increased compared to the same period last year of 17.21%. This may be due to the company's increase in operating income or decrease in operating costs. However, the company's net profit margin for this reporting period was -89.99%, which was decreased compared to the same period last year of -50.06%. This may be due to the company's decrease in net profit. The return on equity (ROE) for this reporting period was -88.77%, which may be due to the company's decrease in net assets and net profit.

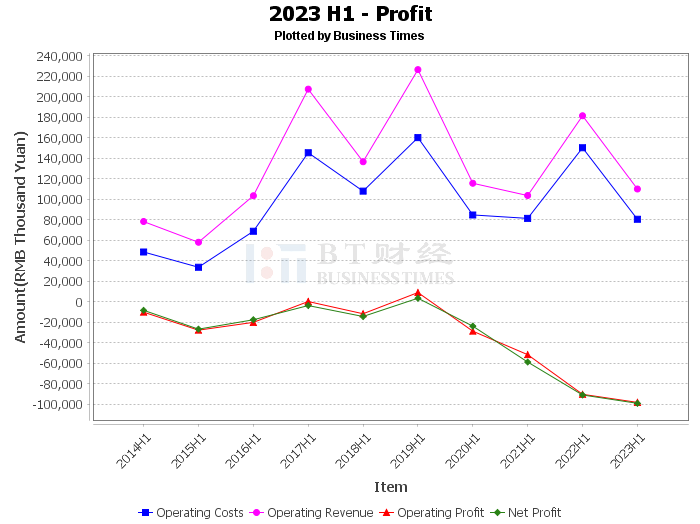

In terms of business conditions, the company's operating income for this reporting period was 110 million yuan, which was decreased compared to the same period last year of 181 million yuan. The operating profit for this reporting period was -98 million yuan, which was increased compared to the same period last year of -90.1 million yuan. The operating cost for this reporting period was 80.4 million yuan, which was decreased compared to the same period last year of 150 million yuan. The net profit for this reporting period was -98.9 million yuan, which was increased compared to the same period last year of -90.8 million yuan.

In terms of cash flow, the net cash flow generated by the company's operating activities for this reporting period was -4.39 million yuan, which was increased compared to the same period last year of -43.7 million yuan. The net cash flow generated by investment activities for this reporting period was -487,500 yuan, which was increased compared to the same period last year of -950,200 yuan. The net cash flow generated by financing activities for this reporting period was 6.95 million yuan, which was decreased compared to the same period last year of 10.3 million yuan. The balance of cash and cash equivalents at the end of this reporting period was 43 million yuan, which was increased compared to the same period last year of 33.4 million yuan.

In summary, although ST Dvsx faced some challenges during the reporting period, such as the decline in operating income and net profit, there were also some positive factors, such as the increase in gross profit margin and the increase in cash flow from financing activities. Therefore, investors need to consider these factors comprehensively when considering investing in ST Dvsx, and make decisions based on their own investment objectives and risk tolerance.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge the capital market data in the most intuitive, fastest way, and from the most professional perspective."