Shanghai Airport 2023 Interim Report: Year-on-year Increase in Operating Revenue, Good Business Performance

"Shanghai Airport (stock code: 600009) is a company dedicated to providing ground support services for domestic and international airlines and passengers. The company manages two airports in Shanghai, namely Pudong Airport and Hongqiao Airport, providing safe take-off and landing services for airlines with advanced airport infrastructure and efficient operation support systems, and providing passengers with a comfortable waiting environment and high-quality services.

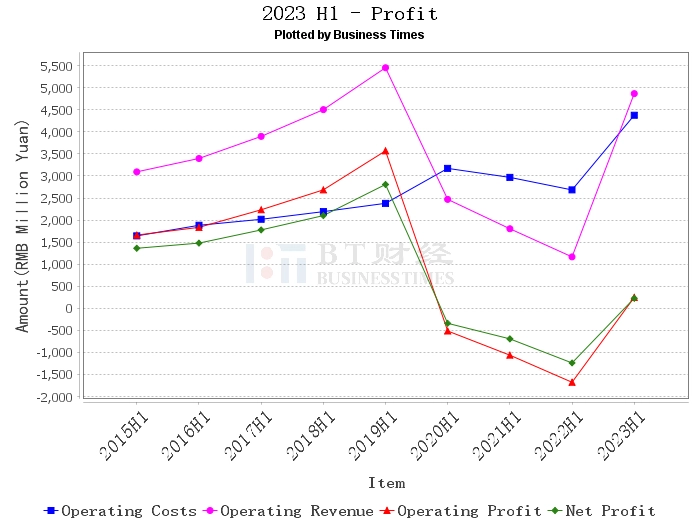

According to Shanghai Airport's 2023 interim report, the company's operating income increased year-on-year, mainly due to the year-on-year growth of aviation business volume at both airports, leading to a year-on-year increase in the company's aviation income, commercial leasing and operating rights transfer income. This indicates that the company's main business performed well, benefiting from the recovery of the domestic economy and the gradual recovery of the civil aviation industry's transport production to the 2019 level.

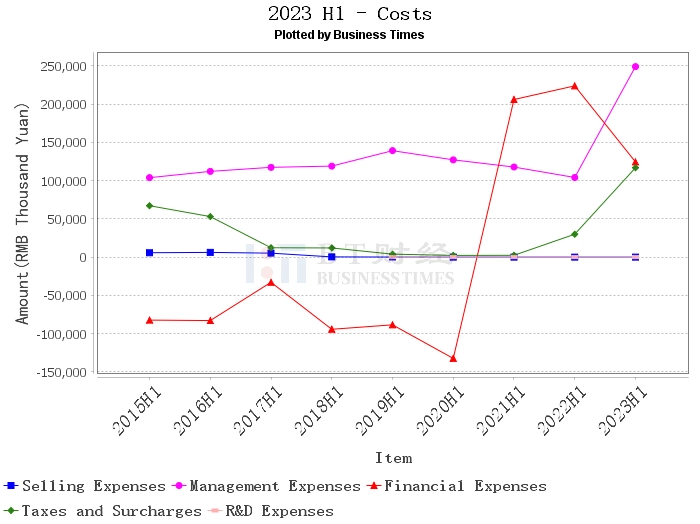

However, the company's operating costs and administrative expenses also increased year-on-year, mainly due to the year-on-year growth of aviation business volume at both airports, leading to an increase in operating support personnel expenditure and management personnel expenditure, as well as an increase in depreciation and amortization costs and office expenses. This may require the company to further analyze cost control and management efficiency.

It is worth noting that the company's financial expenses decreased year-on-year, mainly due to the year-on-year increase in the company's bank deposit interest income and the year-on-year decrease in lease liability interest expenses. This has a positive impact on the company's financial situation.

From the perspective of cash flow, the net cash flow generated by operating activities increased year-on-year, mainly due to the company's operating income increasing year-on-year due to the impact of the year-on-year growth of aviation business volume. This shows that the company's operating activities are healthy. The net cash flow generated by investment activities decreased year-on-year, mainly due to the company's increase in foreign investment expenditure year-on-year, which may require attention to the company's investment decisions. The net cash flow generated by financing activities increased year-on-year, mainly due to the year-on-year increase in cash received from minority shareholders' investment in subsidiaries.

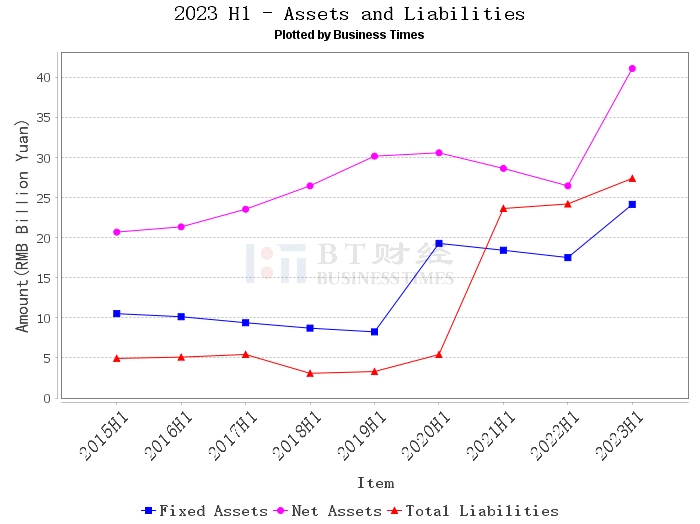

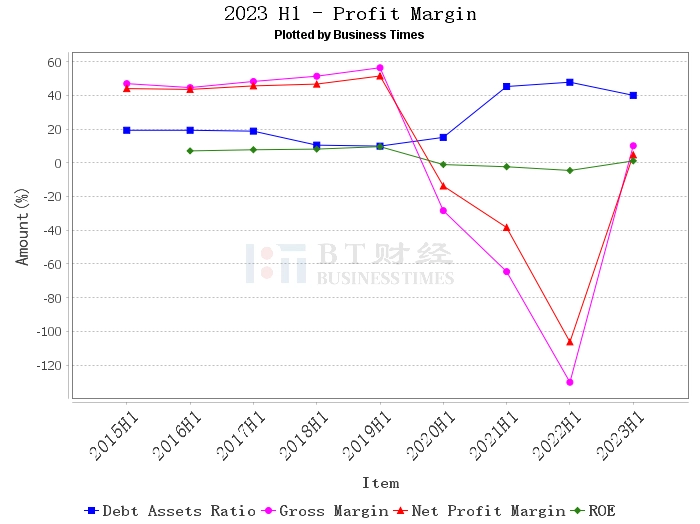

In terms of financial indicators, the proportion of the company's trading financial assets, receivables, long-term equity investments, and other non-current financial assets in total assets have all increased, while the proportion of other current assets in total assets has decreased. This reflects some changes in the company's asset allocation.

In summary, Shanghai Airport's 2023 interim report shows that the company's main business performed well, with operating income increasing year-on-year, but it also faces the pressure of increasing costs and management expenses. The company's financial situation is stable, and the cash flow situation is good. However, the company's investment activities may require further attention. For investors, Shanghai Airport is still a potential investment target, but it is necessary to pay attention to its cost control and investment decisions.

This article only represents the judgment made by the analyst himself or based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."