Oriental Communications 2023 Interim Report: Performance Faces Challenges, but Cash Flow Significantly Increases

"Oriental Tong (stock code: 300379) is a company specializing in basic software middleware and network security business. With years of technological innovation and market expansion, the company provides services and support for enterprise-level core businesses in industries such as finance, communications, government, energy, and transportation. However, according to its 2023 interim report, the company's performance faces some challenges.

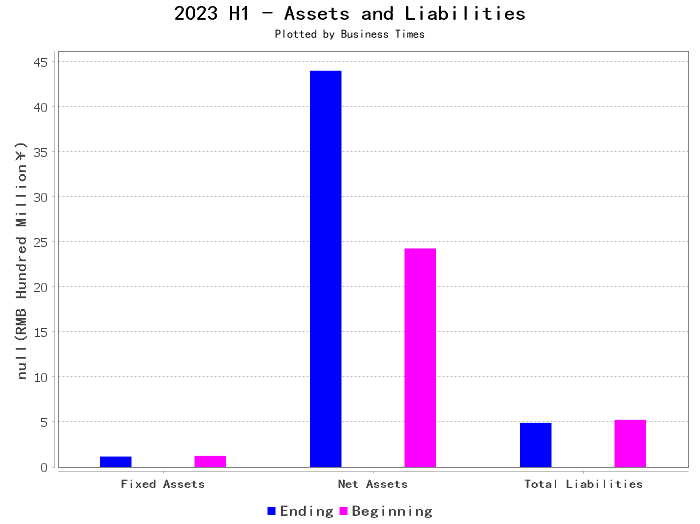

Firstly, from the financial data, the company's total assets increased from 2.949 billion yuan at the beginning of the period to 4.888 billion yuan at the end of the period, a significant increase. However, the company's total liabilities decreased from 523 million yuan at the beginning of the period to 490 million yuan at the end of the period, a relatively small decrease. This may imply that the growth of the company's assets is mainly through financing activities, rather than from operating activities.

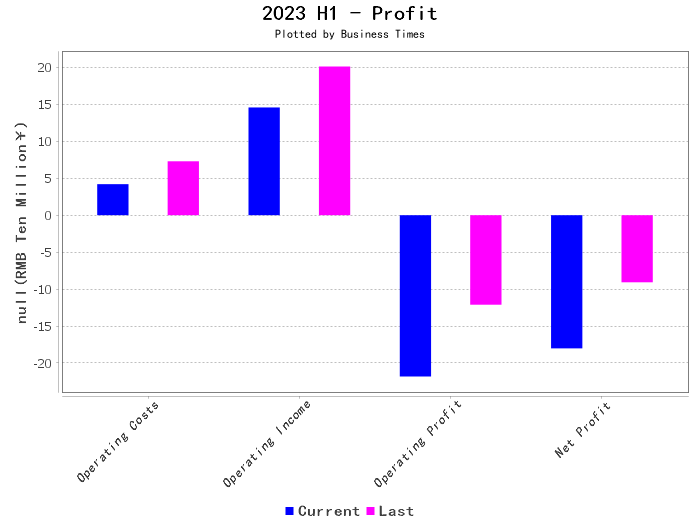

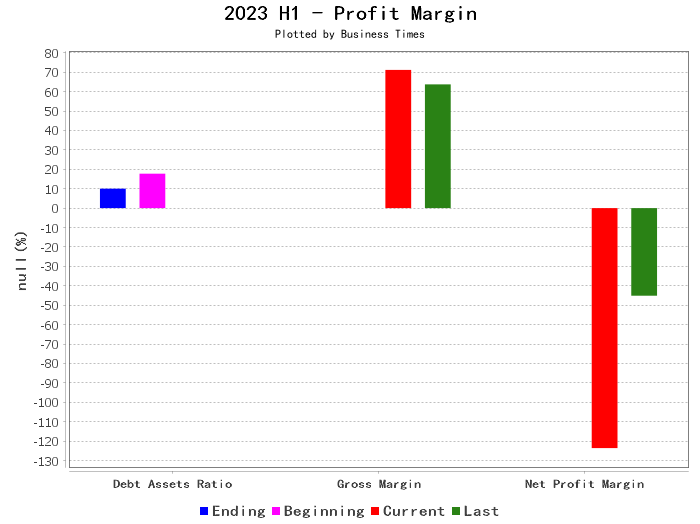

Secondly, the company's operating income in this reporting period was 146 million yuan, down from 201 million yuan in the same period last year. At the same time, the company's operating profit also decreased from -121 million yuan in the same period last year to -218 million yuan in this reporting period. This may indicate that the company's main business income and profitability are declining.

In addition, the company's net profit in this reporting period was -180 million yuan, while it was -90.8 million yuan in the same period last year, with the loss expanding. At the same time, the company's net profit margin also decreased from -45.12% in the same period last year to -123.61% in this reporting period, which may indicate that the company's profitability is declining.

However, it is worth noting that the net cash flow generated by the company's operating activities in this reporting period was -156 million yuan, which was flat compared to the same period last year. The net cash flow generated by the company's financing activities in this reporting period was 2.225 billion yuan, far higher than 37.4 million yuan in the same period last year. This may indicate that although the company's profitability is declining, its cash flow situation has improved.

In general, Oriental Tong faced some challenges in its 2023 interim report, including a decline in operating income and profit, and a loss in net profit. However, the company's cash flow situation has improved, which may provide some support for the company's future development.

As a financial analyst, I suggest that investors should fully consider these challenges and opportunities when considering investing in Oriental Tong. At the same time, investors should also closely monitor the company's future operating conditions and financial status to make more informed investment decisions.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."