Hanwei Electronics 2023 Interim Report: Positive development trends in the sensor and Internet of Things industry, performance under pressure but prospects are promising.

"Hanwei Electronics Group Corporation (stock code: 300007) is a leading provider of Internet of Things (IoT) solutions centered around sensors. Through years of endogenous and exogenous development, the company has built a relatively complete IoT ecosystem, integrating sensor technology, intelligent instrument technology, data acquisition technology, geographic information, and cloud computing. The company's business applications cover sensors, intelligent instruments, comprehensive IoT solutions, public utilities, and home intelligence and health, forming a leading advantage in the industries involved.

However, in the first half of 2023, affected by geopolitical conflicts and anti-globalization factors, the macroeconomic recovery speed and downstream demand were lower than expected, leading to a disproportionate increase in the company's costs and performance output. In addition, the company is actively optimizing and integrating its asset structure, promoting the spin-off of the public business sector, which has had some impact on the company's performance. Despite a year-on-year decline in operating income and net profit in the first half of the year, the overall development trend of the sensor and IoT industry in which the company operates is still positive. The national development plan and the trend of digitalization and intelligence have brought good development opportunities for the company. The company maintains innovative development through R&D investment, seizes market opportunities, and continuously consolidates its industry-leading position. In addition, the company's various business sectors achieved good growth in the second quarter, and it is full of confidence in the second half of the year and future development.

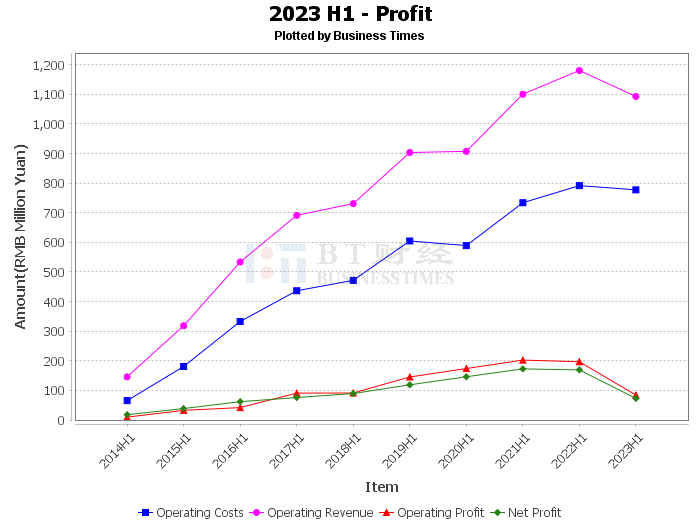

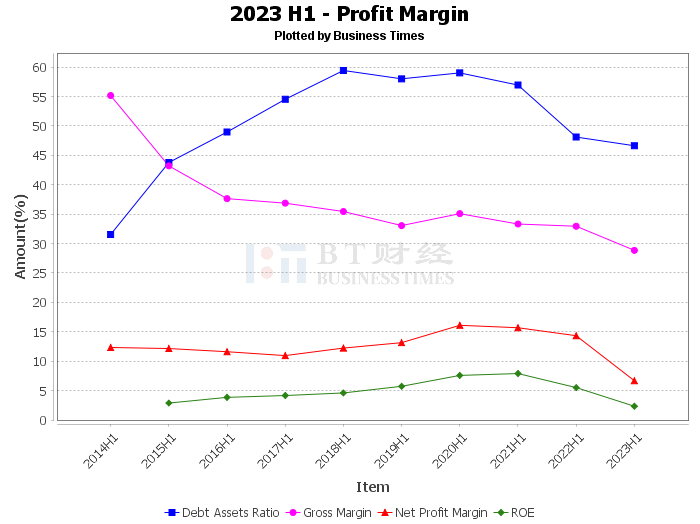

According to financial report data, the company's operating income in the first half of 2023 was 1.093 billion yuan, a decrease from 1.181 billion yuan in the same period last year. Operating profit was 84.2 million yuan, a sharp decline from 197 million yuan in the same period last year. Net profit was 73 million yuan, a year-on-year decrease, with 169 million yuan in the same period last year. In addition, the net profit attributable to the listed company's shareholders after excluding the share-based payment expenses of the equity incentive plan was 74,276,952.35 yuan, a year-on-year decrease of 52.40%.

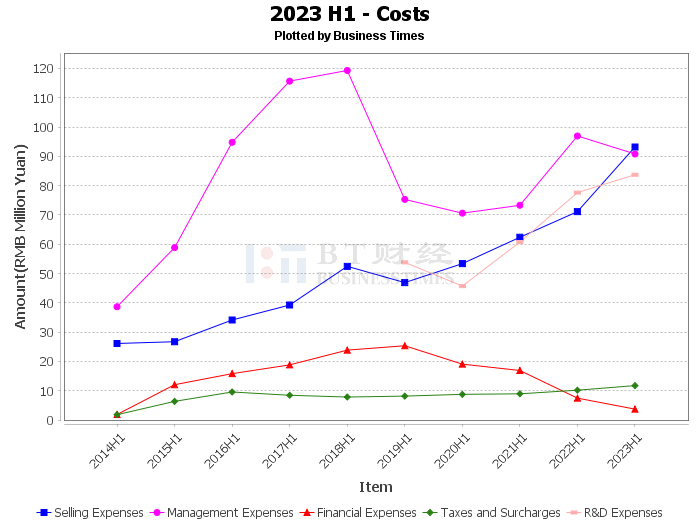

In terms of costs, the company's operating costs were 778 million yuan, a decrease from 792 million yuan in the same period last year. Sales expenses increased by 31.03% year-on-year, mainly due to the company's increased marketing efforts and increased marketing investment. Financial expenses decreased by 50.29% year-on-year, mainly due to changes in the company's financing structure. Income tax expenses decreased by 64.97% year-on-year, mainly due to the company's reduced total profit.

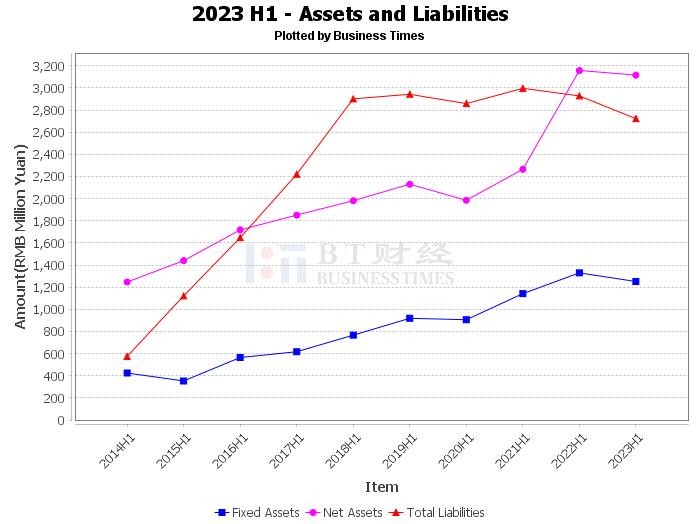

In terms of cash flow, the net cash flow generated by operating activities was -147 million yuan, a year-on-year decrease of 42.55%, mainly due to the decrease in cash received from the sale of goods and provision of services by the company. The net cash flow generated by investment activities was 77.6 million yuan, a year-on-year increase of 161.81%, mainly due to the company's receipt of equity transfer payments. The net cash flow generated by financing activities was -75.8 million yuan, a year-on-year decrease of 207.13%, mainly due to the company's increased profit distribution to minority shareholders.

Overall, although Hanwei Electronics's performance in the first half of 2023 was under some pressure, the company's advantages in the IoT field are still evident, and the industry development trend is positive. The company maintains innovative development through R&D investment, seizes market opportunities, and continuously consolidates its industry-leading position. Therefore, investors considering investing in Hanwei Electronics should take into account the company's performance, industry development trends, and the company's development strategy.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."