Lisheng Technology 2023 Interim Report: Diversified Business Drives Revenue Growth, Net Cash Flow Significantly Increased

"Lisheng Technology (stock code: 300051) is a company with a significant position in the software and technology services industry, providing software products and services in a SaaS model, and possessing strong technical R&D capabilities and core technologies. According to its 2023 interim report, the company has broad development prospects in the software and technology services, photovoltaic cells, and mobile communication resale industries.

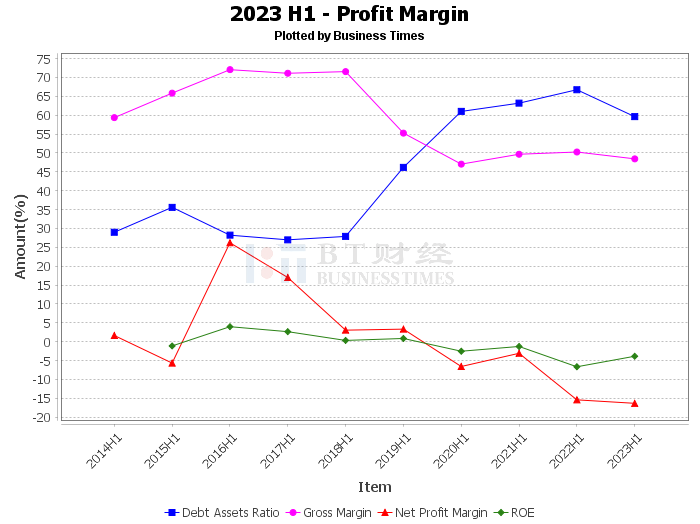

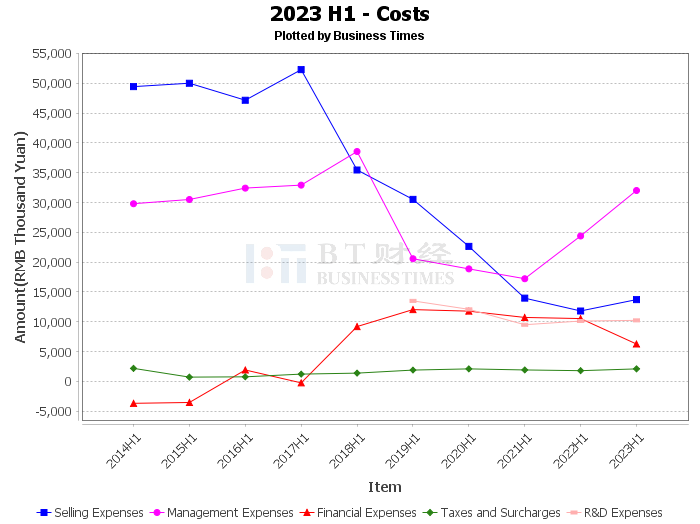

Financial data shows that the company's management expenses increased by 31.27% year-on-year, mainly due to the increased costs of the newly established subsidiary Meishan Liansheng by its controlling subsidiary Tianjin Communication. Financial expenses decreased by 40.51% year-on-year, mainly due to the increased interest income from time deposits and decreased interest expenses from bank loans during this period. Income tax expenses increased by 161.37% year-on-year, mainly due to the increased income tax expenses provided by its subsidiary Sangfor Digital during this period.

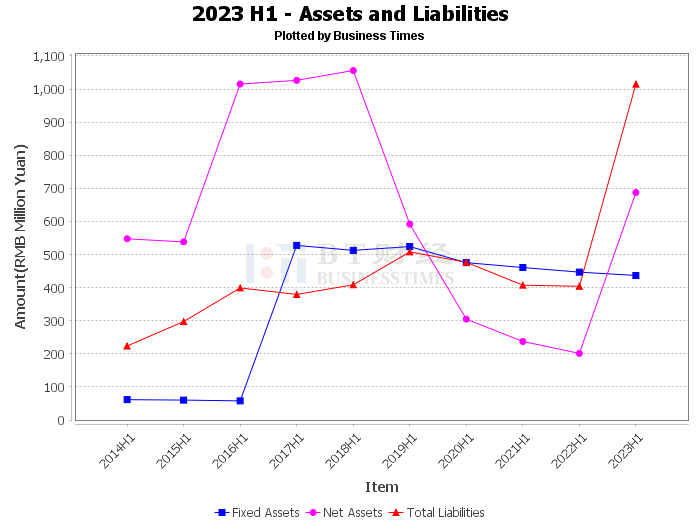

The net cash flow from operating activities decreased by 62.28% year-on-year, mainly due to the increased costs of the newly established subsidiary Meishan Liansheng by its controlling subsidiary Tianjin Communication and the decreased net cash flow from operating activities generated by its subsidiary Daoxi Technology. The net cash flow from investing activities decreased by 469.94% year-on-year, mainly due to the cash paid by its subsidiary Meishan Liansheng for the purchase and construction of fixed assets, intangible assets, and other long-term assets. The net cash flow from financing activities increased by 689.01% year-on-year, mainly due to the capital increase received by the company's controlling companies from minority shareholders during this period. The net increase in cash and cash equivalents increased by 1093.03% year-on-year, mainly due to the capital increase received by the company's controlling companies from minority shareholders during this period.

The company's total assets at the end of the period were 1.702 billion yuan, and the beginning balance was 585 million yuan. The total liabilities at the end of the period were 1.015 billion yuan, and the beginning balance was 405 million yuan. The net assets at the end of the period were 687 million yuan, and the beginning balance was 180 million yuan. The asset-liability ratio at the end of the period was 59.62%, and the beginning was 69.19%.

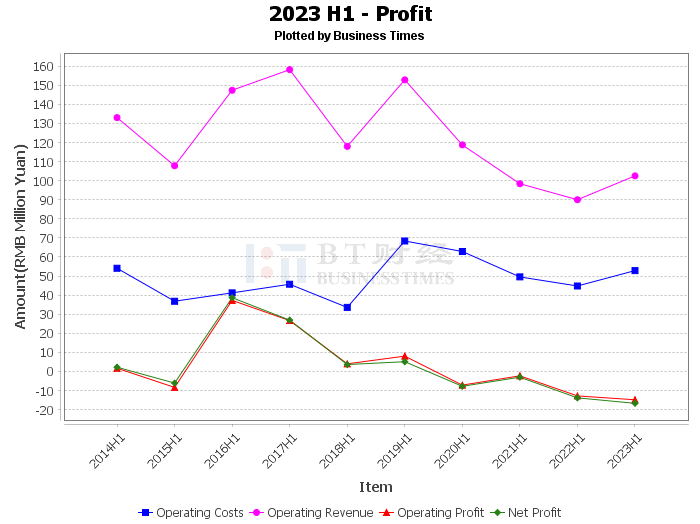

Operating income for this reporting period was 102 million yuan, compared to 90 million yuan for the same period last year. Operating profit for this reporting period was -14.9 million yuan, compared to -12.8 million yuan for the same period last year. Operating costs for this reporting period were 52.8 million yuan, compared to 44.8 million yuan for the same period last year. Net profit for this reporting period was -16.7 million yuan, compared to -13.9 million yuan for the same period last year.

Overall, Lisheng Technology demonstrated a robust development trend in its 2023 interim report, and its diversified business layout has brought steady income growth to the company. Although the company's net cash flow from operating activities and investing activities has declined to some extent, the net cash flow from financing activities has significantly increased, resulting in a substantial year-on-year increase in the company's net increase in cash and cash equivalents, indicating the company's good cash flow situation. In the future, Lisheng Technology will continue to deepen its involvement in the software and technology services, photovoltaic cells, and mobile communication resale industries to achieve greater development. Investors can pay attention to its subsequent performance.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."