Wanshun New Material 2023 Interim Report: Performance Under Pressure, Continuous Expansion in New Material Business

"Wanshun New Material (stock code: 300057) is a company focused on the new materials industry, primarily engaged in three major businesses: aluminum processing, paper packaging materials, and functional films. The company has an independent and complete system for raw material procurement, R&D, production, testing, and sales network, adopting an order production model to produce according to customer needs, ensuring timely and quality completion of production tasks.

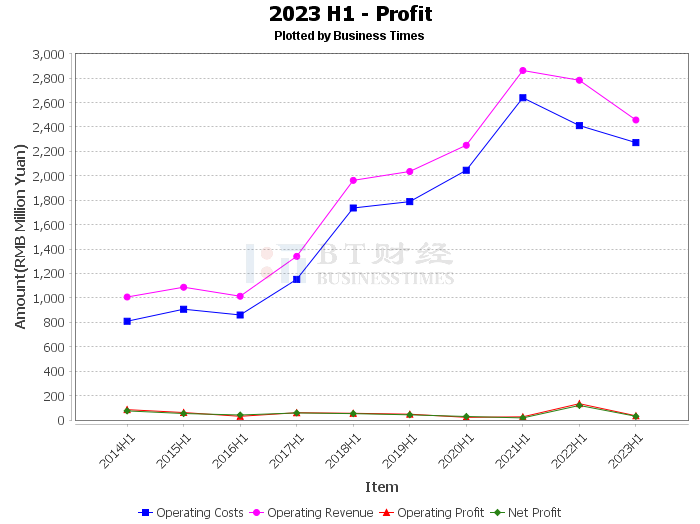

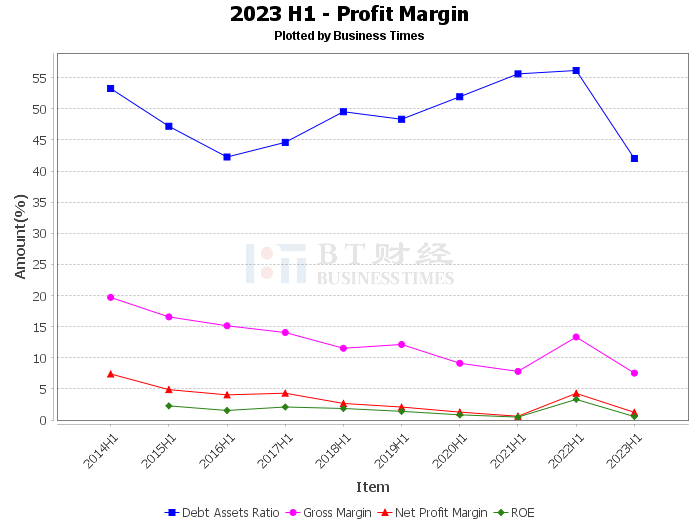

However, in the first half of 2023, due to factors such as the slowdown in de-stocking demand from downstream customers and fluctuations in domestic and foreign aluminum prices, the company's overall performance declined. Operating income was 2.457 billion yuan, a year-on-year decrease of 11.69%; The net profit attributable to shareholders of the listed company was 31.1941 million yuan, a year-on-year decrease of 74.15%. Despite facing pressure, the company continues to build core competitive advantages in the three major business areas of aluminum processing, paper packaging materials, and functional films.

In terms of aluminum processing business, the company produces aluminum foil, aluminum strips, and carbon-coated foil, mainly used in electronic components, packaging, and daily use fields. Despite the impact of the slowdown in de-stocking demand from downstream customers and fluctuations in domestic and foreign aluminum prices, the company continues to build an integrated industrial chain advantage of aluminum strips, aluminum foil, and carbon-coated foil, and fully expands the application of battery aluminum foil in the power, energy storage battery market, and high-end double-zero aluminum foil business market.

The paper packaging materials business mainly produces transfer paper and composite paper, used in cigarette labels, liquor labels, daily chemicals, and gift packaging fields. Despite the impact of the full implementation of cigarette two-dimensional codes in the cigarette packaging industry, the company actively cooperates with customer revision requirements for proofing. As downstream customers have completed packaging revisions one after another, the paper packaging materials business has recovered.

The functional film materials business covers high barrier films, conductive films, energy-saving films, car clothing films, and nano-dazzling films, etc., applied in photovoltaic packaging, food and drug packaging, electronic device packaging, display packaging, touch screens, and mobile phone back cover glass decoration fields. During the reporting period, the company's functional film product business achieved operating income of 25.4209 million yuan, a year-on-year increase of 123.63%, mainly because the company focuses on product markets with development potential, continuously adjusts product structure, increases the market expansion efforts of photovoltaic high barrier films, high-end packaging barrier films, and car clothing film products, and gradually opens up the sales market.

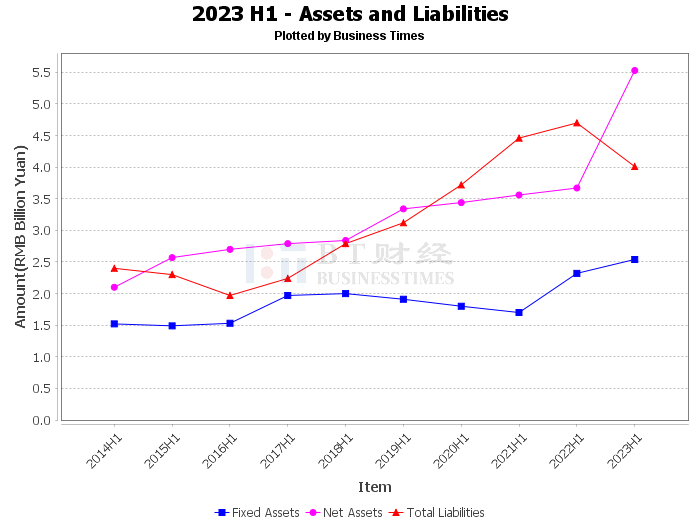

Financially, the company's total assets at the end of the period were 9.531 billion yuan, the total liabilities at the end of the period were 4.005 billion yuan, and the asset-liability ratio was 42.02%. The balance of cash and cash equivalents at the end of the period was 1.763 billion yuan. The net cash flow generated by operating activities was 190 million yuan, the net cash flow generated by investment activities was -510 million yuan, and the net cash flow generated by financing activities was -404 million yuan.

Overall, while facing the pressure of performance decline, Wanshun New Material continues to expand in the field of new materials, demonstrating strong market adaptability.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."